Comments from Your Neighbors

Mona Sheppard is an Essex resident who knows all about finance and good government, thanks to a decades-long career spanning both fields. We are fortunate to have permission to reprint her well-researched Front Porch Forum postings.

Your Vote is Important

Mona Sheppard • [email protected] • Greenfield Road

Dec 12, 2016

As you may know, town employee Ally Vile recently sent an email along with School employee Brad Luck expressing their views on the upcoming vote concerning the formation of a new governmental entity to govern the parks and recreation departments. My husband and I were both recipients of that email.

The Town of Essex Employee Handbook states that "No political activities or solicitations will be conducted on Town owned property", "Political activities are defined for the purpose of this policy as activities in support of any partisan political issues or activities", and "An employee shall not publicize or promote his or her Town employment in any activities and campaigns and shall not, in any manner, suggest that he or she represents any official position or support."

It appears that Ms. Vile violated Essex Town employment policies concerning the use of conducting activities on Town property by utilizing the town server/computer system and the recreation department records to send an email to promote her political view. Rather than identifying any of her comments as her personal opinions, she actively promoted them as the views held in her position as Director of Parks and Recreation for the Town of Essex.

If I understand the employment arrangement, the school district is Mr. Luck’s employer. CCSU conflict of interest policy states that “School employees engaging in political activity will make it clear that they are speaking and acting as individuals and that they neither represent the school district nor the views of the Board.” It would appear that Mr. Luck violated the school conflict of interest policy.

Contrary to both policies, the email from Ms. Vile and Mr. Luck begins with “We write today as the Directors at Essex Parks & Recreation (EPR) and Essex Junction Recreation & Parks (EJRP)”, after which they discuss the upcoming vote on December 13th and their views on that vote and comments on their favored governance model. There is no mention that these are personal views. They point out that they are writing in their positions as employees and they sign the email with their job titles. The email was sent from [email protected] which is not their personal address.

I'm sure you would agree that any promotion of a political view or use of taxpayer supported resources and equipment by a town employee would not be acceptable behavior. Town and school employees are servants of all the people, no matter what their personal views are. Town and school employees are in a special position where their employment or title may unduly sway voters in political situations and they should remain neutral in any such situations. That is why municipalities and other public entities have such employment policies.

I can only hope that the town and school district follow up on these alleged violations and possible similar activities by any other managers or employees that may have unduly affected the outcome of the upcoming vote on the formation of a special tax district for recreation and parks of the town and village.

There are many disadvantages to forming another tax district in our community. Please don't let such manipulations affect your vote and join me in voting "NO" to another layer of bureaucracy in Essex.

Essex Recreation STD

Mona Sheppard • [email protected] • Greenfield Road

Dec 8, 2016

Last Monday, I made a public records request for the list of email recipients that Ally Vile, Essex Parks & Recreation Director and Brad Luck, Essex Junction Parks & Recreation Director used to send their email blast out earlier this week. I believe another individual also made a request.

Rather than simply provide the listing, the town checked with their attorney to make sure they had to supply this public record. Town management doesn't know public records laws? Or is it that they don't mind wasting more taxpayer dollars for legal fees related to their quest for a recreation STD and to try to squeeze out some legal delay ruling ?

Today I received the listing and also today Ally sent a second email telling everyone they can opt out of the listing now that it is public. How much public employee time has been wasted on this controversial proposal? It's very discouraging when those who are supposed to be "public servants" are instead pushing their personal agendas with taxpayer dollars. What is the management of Essex really doing?

Are they serving us or themselves?

Please be sure to vote "NO" on December 13th or prior by absentee ballot. When a government is secretive rather than transparent, the odds are it's not good for taxpayers.

Special Recreation Tax District

Mona Sheppard • [email protected] • Greenfield Road

Dec 6, 2016

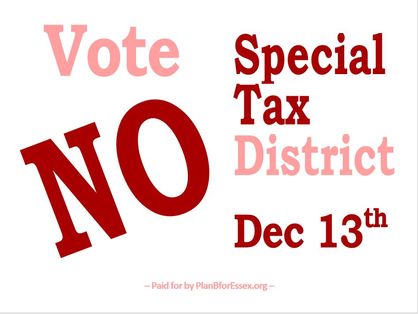

Please vote "NO" at the upcoming special election to form a new Special Tax District on December 13th to govern the town and village parks and recreation departments.

The proponents of the district, which according to a recent email blast to all recreation users includes the current directors of the Essex and Essex Junction Recreation departments, Ally Vile and Brad Luck, have had free access to town resources to send out glossy post cards, use town email lists, create a new web site, use town staff, pay legal fees,and hold public forums in public buildings. Just like good old fashioned in the streets democracy, those of us opposed to higher taxes and another layer of bureaucracy are relying on newspaper letters to the editor, front porch forum postings, letters to our legislatures, volunteers to do research and make contacts, and small private donations to pay for our web site PlanBforEssex.org, and a few street signs.

Please visit our web site and read my postings from the past few months detailing my findings about STDs, the shortcomings of the agreement we will be voting on, and other areas of misinformation put out by the proponents of the district.

Town management, legislature, and staff have currently proposed that the town do all the tax billing for the new district as well as serve as their treasurer and finance departments. The town will lease all of our parks to the district for a token amount of one dollar, but the district will maintain the assets. They will be able to request the town's $600,000 capital reserve as well as bond and take on other debt. These items and others, lead me to believe that already the district cannot be self supporting, but needs the towns's resources to survive.

If you want to protect our parks and maintain a reasonable recreation budget, please vote "NO" on December 13th or by absentee ballot. Contrary to what Brad and Ally said in their email blast, we are not afraid of change. We are opposed to increasing taxes and bureaucracy and jeopardizing our beautiful park system.

Vote "No" Early or on Dec. 13

Mona Sheppard • [email protected] • Greenfield Road

Nov 21, 2016

Early voting for the Special Tax District (STD) to take over the town and village recreation departments as well as the town and village parks begins this week.

This proposal will take away town control of the recreation department, lead to increased tax rates for the town, create another taxing district that can issue bonds, and create one more layer of bureaucracy that the voters will have to worry about.

I strongly urge a "no" vote on the creation of this district. Please read my previous postings as a counter to the spin being presented by the recreation study committee.

Whether you're going to do early voting or wait until December 13th to vote, please vote "no".

Local Government Transparency

Mona Sheppard • [email protected] • Greenfield Road

Nov 7, 2016

Last week I read the letter to the editor in the Essex Reporter by resident Bruce Post. He referred to a joint meeting of the trustees and the selectboard on June 6, 2012 that established a Committee of Six to study merger issues. The minutes weren't posted on the town website as required by law and he had to file a public records request in order to obtain them.

Imagine my surprise when I went to the town website to read those minutes and found they still aren't posted as required by law! I've made a public records request of Town Manager Pat Scheidel to get a copy. Why do the residents of the town have to make individual requests in order to get information that is our right to see and town management's responsibility to post? One would think that after Mr. Post’s public records request, town management would post the missing minutes. At this point, not so.

According to selectboard member Sue Cook at an August meeting, "the Town of Essex and Village of Essex Junction are on a trajectory to, at some point, consolidate". When and how was that decided? Was there a vote? Who is this committee? If the town and village are merging/consolidating, why is there a push to create a Special Tax District for Parks and Recreation?

At the last town meeting, when asked where the supposed $775,000 savings from current department mergers is reflected in the budget, SB Chair Max Levy stated that “the town didn't receive those savings in dollars". So ... was it in chickens? If there is no tax savings, what is going on with the merger of services? Is this simply empire building? Power grabs? The promise of lower taxes in the future or a smaller increase in taxes is simply pie in the sky.

Town Manager Pat Scheidel, when discussing the ongoing debate about a special tax district for parks and recreation and in referring to the people who pay his salary, recently said there are “people in our community… who have been overly zealous in scrutinizing processes?”

Count me one of those people. The last time I looked, I was still living in a democracy. And that demands government transparency.

Recreation Tax Rate Comparisons

Mona Sheppard • [email protected] • Greenfield Road

Oct 22, 2016

A recent reply from the Essex Recreation Governance Study Group to my posting concerning the tax rates of the Essex Junction Parks and Recreation (Village) and the Essex Parks and Recreation (Town) claims that it is misleading to compare the tax rates of the two recreation groups. Actually, it's not misleading. It's math.

The study group doesn't deny that the tax rate for the Village is 6.85 cents and the tax rate for the Town is 3.10 cents.

The numbers:

The Village recreation department collects $744,000 in taxes for parks and recreation based on a grand list of $10.9 million and a population around 10,000. That is a tax rate of 6.85 cents.

The Town recreation department collects $784,000 in taxes for parks and recreation based on a grand list almost double at $25.4 million and a population double the village at around 20,000. That is a tax rate of 3.10 cents.

Currently, the town can run a department for a town twice the size in grand list value and in population for only $40,000 more, keeping the tax rate low. Village recreation having a smaller grand list and population, should be run on half the amount of money the currently collect.

Based on the math, if the two departments merge and are run the same as they are now, you can expect taxes for residents outside the Village to increase and for residents in the Village to decrease.

I recommend a vote of "no" for the recreation taxing district.

Independent Budget for Special Tax District

Mona Sheppard • [email protected] • Greenfield Road

Oct 17, 2016

One of the questions that the Recreation Governance Study Group answered in a recent hand out had to do with what they call an "independent budget". By the group's definition, "an independent budget is money that the community will vote to approve that will only be utilized to support Essex Community Parks & Recreation." Their argument is that they are unique from other governmental functions because recreation collects taxes, but also revenue for programs.

They may be special, but they aren't unique. According to the most recent Audited Financial Statements for the town of Essex, other government activities that collect fees are general government, public safety, highways and streets, health and welfare. Other business type activities are water and sewer. All of these are included in the Town budget and are not in a Special Tax District.

I strongly disagree that an independent budget is a good idea and so do many taxpayers associations and watchdogs. Special districts which guarantee a tax revenue stream for only certain programs are bad tax policy. Budget planning needs all programs competing with each other for spending priorities in the budget. The taxpayers only have a limited amount of money and, budget shortfalls may force a town to lay off essential fire or police personnel or to not maintain roads to a high safety standard, while the Special Tax District still receives all its taxes.

Competing with other departments and having taxpayers vote on the entire municipal budget as one, helps keep tax rates in check. As an example, Essex Junction Parks and Recreation has an independent budget and their tax rate is 6.85 cents. The Essex Town Parks and Recreation doesn't have an independent budget and their tax rate is 3.1 cents.

The Town outside the Village is asked to merge with a recreation department that has a higher tax rate then our own and we are asked to increase our taxes in the name of "equalization".

I urge a "no" vote on formation of a new Special Tax District for Parks and Recreation.

Real Life Example: Special Tax District

Mona Sheppard • [email protected] • Greenfield Road

Oct 12, 2016

The proposed Special Tax District (STD) is speeding along, but there are still no answers to the questions concerning the dissolution of the Town of Essex Parks and Recreation Department. If this STD is approved, the town will no longer have a recreation department. Town recreation will be governed by a separate entity with all power in the hands of a five member board of directors with no oversight from the town management or Select board.

I've been told that there is nothing to fear here. We've been told to take a look at Snyderville Basin Recreation District in Utah. I checked their numbers.

Snyderville Basin has a bit over $3.0 million in general fund tax revenue and $1.4 million in program fees for a combined $4.4 million. That relates somewhat to the current combined numbers for the Town of Essex and Village of Essex Junction with $1.5 million in general fund tax revenue and $2.0 million in program fees for a combined total of $3.5 million. Pretty similar.

But, as we've heard and read, STDs have a tendency to bond and borrow and have uncontrollable, continually rising taxes. Snyderville seems to have proved that! According to their 12/31/2015 Audited Financial Statements, they have bonds outstanding in the amount of $58,780,000! To make payments on those bonds, they collect an additional $4,700,000 in tax revenue annually! That tax is also collected on property value.

But there's always more.

Their board passed a resolution in January, 2015 to institute Impact Fees on new builds - both residential and commercial - which brings in an additional $587,000 in revenue. That may be called a fee, but it's a tax in my world.

If Essex moves along according to this wonderful Utah district we are told to hold up as a model, we'll see large capital projects funded by bonding and increased taxes. Since the study group has said that a major reason to choose an STD is the ability to borrow money and the lack of pressure from other town budget needs, I find no reason to doubt that there will be both borrowed money and increased taxes.

Whose Parks & Recreation District?

Mona Sheppard • [email protected] • Greenfield Road

Sep 26, 2016

The proposed new special tax district to house the Town of Essex and Village of Essex Junction Parks and Recreations appears to have wide ranging goals. The recreation study group have indicated in their meetings that they may expand to include a new senior center or a farmers' market among other ideas.

In addition, although the name of the STD will be Essex Community Parks & Recreation, it is not limited to only the Town of Essex and Village of Essex Junction. According to the district's forming agreement that voters will be asked to approve in December, members of the district will also include any other municipality that joins the district.

How does another municipality join the district? Again, according to the agreement, the district's board of directors would need to vote in favor of the added municipality and then hold a special meeting of the voters of the district.

Our local legislatures and the recreation study group continue to tell us that this new STD is a way to keep the two recreation departments on an even footing. They also say that it is a better way to vote -- all by Australian vote rather than just a vote at a meeting. Yet one of the most important items is left to the board of directors and one special meeting -- no Australian vote.

Think of this -- If another town joined, we could end up with directors of the Essex Community Parks and Recreation not living in either the Town or the Village.

Wait -- there's more -- In addition to actually adding other municipalities to the district, the agreement allows other municipalities to contract for one or more services -- all at the discretion of the board. That means our Parks and Recs services are for sale to other municipalities based on the decision of a five member board.

I would urge a "no" vote on any new recreation taxing district. I hope the voters keep our Parks and Recreation under the Town or Village control.

The Selling of the Parks and Recs STD

Mona Sheppard • [email protected] • Greenfield Road

Sep 20, 2016

The Recreation Governance Study Committee continues to run its public relations program to push for the a "yes" vote on forming a Special Tax District for the combined Parks and Recreation Departments currently serving the Village and Town.

According to the group's May 4th minutes, they decided that "Once a recommendation is made to the Selectboard and the Trustees, public engagement will morph into selling the recommendation to the public".

"Selling the recommendation to the public" is not informing the public of the facts for all the options. If they're selling, what are we really buying?

In their June 22nd presentation to the joint boards, they try to sell this by saying many of the other options would leave the Parks & Recreation funding "compromised by other municipal needs." They've reworded that on their website now to say "concern of rec related funds not solely being used for recreation".

I'd like to know if these are real concerns or imagined. When did the town management and finance department use recreation program fees for anything other than recreation program costs? How often does that happen? Good accounting would dictate that these proprietary program funds not be mingled with general funds. Is this happening?

If the concern is not that the recreation program fees are being misused, but that the recreation department budget increases are held in check because of other department needs (road repair, snow plowing) that's what municipal budgeting is about. Prioritizing and compromising with taxpayer dollars.

In reading the minutes it appears that most of the "study" of this study group was to break up into smaller groups and brainstorm without actually researching real life example of these structures, nor how they function in their individual missions. Listing examples of various types of models isn't the same as reading their agreements or charters, comparing their budget sizes, reviewing actual assets managed, or discussing financing options used with their representatives.

For example, the committee notes there are no "pros" for the "non-profit" structure. As a "con", they site a "concern of oversight and transparency of large amount of public tax dollars".

Let me sight one example of a successful local non-profit -- the Underhill-Jericho Fire Department. They have plenty of oversight because this non-profit that serves two communities develops the budget with input from the towns being served, has approval from the boards of the towns for their final budget, and has direct taxpayer input at town meeting because the "tax" is a line item in the town budget. Much more oversight then a five-member board of an STD.

The minutes for the June 14th Essex Junction Board of Trustees include input from Trustee Lori Houghton, also a member of the Recreation Governance Study Committee, stating that after the State Attorney General approves the bylaws (agreement), "the committee can disband. Another committee will then be formed to do public outreach and education for the vote". That didn't happen. This study group has dug in and will not let go. They have appointed themselves the only people who can inform the public of the reasons to choose forming an STD. Why is that? If it is good research, supported by valid arguments, anyone should be able to present the options as studied and let the voter make an informed decision.

The "selling points" presented lack substance and are not supported with any real life examples of success or failure. They are full of generalities and vagueness.

I urge a "no" vote in December.

Recreation STD - Let's Talk Facts Part II

Mona Sheppard • [email protected] • Greenfield Road

Sep 16, 2016

Don’t believe everything you read — do your research.

Essex Junction Trustee Elaine Sopchak tried to counter various items from the Goldwater Study of Special Tax Districts (STD) in a recent Perspective in the Essex Reporter. As stated in my previous post, her research is full of factual errors.

She lists three STDs that she says are excellent examples and similar to the recreation STD. The Tri City Wastewater “District” is an agreement among three municipalities to use excess waste water storage facilities. They do not levy a tax. The towns sign the agreement (contract) which does not last into perpetuity as an STD does and an agreed upon fee is paid based on usage. The Union 46 School District is formed under a different statute then a municipal STD.

One of her examples, the Chittenden Solid Waste District (CSWD), is an STD. But the truth is that STDs are not all created equal. Therin lies the rub. CSWD has its own agreement just as the Recreation STD has its own.

Here are some major differences.

Composition: CSWD allocates votes to the Town of Essex and the Village of Essex as two separate entities - voters of the Village are entitled to vote only as a Village resident, they are not entitled to a second vote as a Town resident. The Recreation STD would allow Village residents to vote on taxes, changes to the agreement, dissolution, etc. as both Village residents and town residents. The result - in the Recreation STD they can vote twice.

Board of Commissions: CSWD has one commissioner from each member municipality appointed by the municipal legislative body, thus guaranteeing that the views and plans of the municipality as a whole are represented. The Recreation STD has a five member board of directors and after the initial election, there is no allocation of directors between municipalities meaning the elected officials are more likely to represent their own interests and reelection and they would not report back to the municipal boards.

Voting: With CSWD, each Commission Member is entitled to cast one vote for every 5,000 population or portion thereof. In the Recreation STD, each of the five members of the board have one vote - regardless of population represented.

Termination of Membership: A member municipality may vote to terminate membership after one year in the CSWD. The Recreation STD ties a member municipality in for at least five years before they can vote to terminate membership.

Appropriations: If the CSWD user fees and revenues do not meet the expenses, each member municipality is assessed a percentage of the obligations, based on the amount of the solid waste generated by them to the whole District - prorated usage. The Recreation STD will tax based on their expenditures without any measurement of usage or amount of municipal assets utilized.

Surplus: If the CSWD ends the fiscal year with a deficit or a surplus, that amount must be included in the operating budget of the following year. The recreation STD allows for any surplus to be used as the Board of Directors decides - it does not need to be returned to the members as a reduction in taxes.

I agree. Do the research. Check the facts.

If the creation of the STD goes to ballot as is proposed and is voted down, the Village Trustees have said they will assume governance of the Essex Junction Parks and Recreation department. Problem solved.

Recreation STD - Let's Talk Facts Part I

Mona Sheppard • [email protected] • Greenfield Road

Sep 16, 2016

I agree with Elaine Sopchak -- Don’t believe everything you read -- do your research.

Ms. Sopchak tried to counter various items from the Goldwater Study of Special Tax Districts (STD) in a recent Perspective in the Essex Reporter. Unfortunately, her research is full of factual errors.

She states that Vermont doesn’t impose debt limits on cities and towns so the concern that STDs circumvent debt limits imposed by the state is irrelevant. Vermont Statutes Title 24, Chapter 53, Paragraph 1762 states that a municipality cannot incur an indebtedness for public improvements which in the aggregate with previous indebtedness would exceed ten times the last grand list of the municipal corporation. That means that the Town of Essex could bond public improvement in an amount 10 times the grand list and the STD could do the same -- doubling the debt limits.

Ms Sopchak states that any increase in the STD taxes would result in a reduction in the Town taxes. There is no way to predict what the Town taxes will do. However, when governments get tax rates set, they seldom reduce them for any reason. I can’t say they will go up and she can’t say they will go down. We simply don’t know and there are many unmet needs in all municipal governments begging for revenues.

Ms. Sopchak asserts that the STD wouldn’t increase tax rates because the EJRP runs “like an STD” and has had a stable tax rate for 10 years. That’s a bit misleading - the past does not always predict the future. In fact, over the past few years EJRP used a prior surplus to help keep the tax rate in check. Worse still, according to their last budget presentation, they say they have “expanded programming to nearly maximum capacity which will limit increases in program revenue in the future years. This is likely the final year EJRP can present a budget with a level tax rate.”

What other costs will need to be picked up by the STD that will inflate the recreation budgets? The transition team has a two page list of items to budget for additional costs. The Village Parks and Recs has an outstanding bond for over $500,000 that won’t be paid off until 2019. That means the tax rate for the Village residents will have to be greater then the tax rate for the Town because the Town residents cannot legally be made to pay for a bond they didn’t approve.

We also don’t know what deferred maintenance is lurking and in the June 30, 2015 audit, EJRP had only $5,268 in Capital Project Funds available. Their Budget Presentation also states that the swimming pool is nearing 20 years old and will need repairs. What else is there that will lead to higher taxes since the STD won't be constrained by municipal budgeting.

The Town Parks and Recreation has over $600,000 in a capital reserve which is on the STD request list. Hopefully, our legislature won’t turn it over to them. The Town Recreation Capital Budget (these are taxes not included in the general tax rate) for the next 5 - 10 years includes $365,000 remodel for Memorial Hall which is considered a park, $30,000 for a Recreation Program Space Feasibility Study, $227,268 for Park Assets Replacements, $66,000 Milfoil Mitigation at Indian Brook, and $181,000 Indian Brook Dam Repairs. That doesn’t include the Capital Budget of $679,270 for Paths & Walks - some of which could be in Parks. The Town Administrative Director, Doug Fisher, doesn’t know the appraised value of the Town Parks, but the book value is $3,574,505. If the new STD is to maintain the Town Parks and other assets in a fashion similar to the Town, they will need to raise taxes for these capital items. Taxes that are in addition to their regular operating funds.

Ms Sopchak says that STD elections will be held at the same time as Town Meeting Day. The STD agreement is very clear concerning the timing of elections. Their elections are in April. Town Meeting is in March.

Check my next post for the differences between the STDs she uses as examples and the agreement for the Recreation STD. They are quite different.

Proposed Essex Recreation Tax District

Mona Sheppard • [email protected] • Greenfield Road

Sep 7, 2016

The committee appointed to study various options to reorganize the recreation departments for the Village and the Town has made a decision without doing due diligence. They are asking the town taxpayers to ante up for a new taxing district that will be separate from the Town or the Village. They prepared no comparative budget estimates to weigh the economic consequences to households in the Town and Village. Now they ask for us to be patient while they come up with a budget for the one option they did choose.

What will be in the budget? Some samples: The town has capable employees in HR, IT, Insurance, and Management functions. The Special Tax District (STD) needs to hire employees to perform those functions. The Town owns all the Town parks. The STD will need the Town to either sell, give, or lease them our wonderful assets. Town and Village recreation personnel who now are employees of the Town or the School District, will be employees of the new STD with STD wages and benefits. The Town prepares its budget taking into consideration all pressures of the taxes on its citizens, whether those taxes plow our roads or fund our swimming classes. The STF will prepare its own tax rate, not taking those other municipal needs into consideration.

By the committee's own power point presentation, a main reason for not looking into three of the other options was "Not chosen due to concerns of funding being compromised by other municipal needs."

The committee has submitted an agreement, asking the State Attorney General's office for approval for this new tax district that would start out governing only the town and village recreation departments, including recreation and park property. The agreement allows for adding other geographic areas or other functions to be added to its base. Taxes will be based on the grand list used for municipal taxes. If we don't like the set up - we can't vote to leave the district for five years or if the district has an outstanding bond!

A transition team is in the process of developing a budget and will also be asking the selectboard for non-binding resolutions, letters of intent, etc. concerning subjects such as leasing town parks or paying the town to do administrative work such as preparing and sending out tax bills. None of those items can be firmly established until the tax district has a Board of Directors. That means that no matter what the team comes up with as a budget it can all get thrown out the window when the tax district Board is elected and meets.

For more information on the opposing views and facts please visit planbforessex.org -- This site was put together by concerned citizens who would like to share our research with the voters.

Recreation Tax District Not Needed

Mona Sheppard • [email protected] • Greenfield Road

Aug 26, 2016

The June 22, 2016 minutes of the Recreation Governance Study Group details why they rejected the majority of the other options for the future of town and village recreation departments and instead zeroed in on a new special tax district. They did not want recreation funding to be compromised by other municipal needs.

Nationally, this is one of the major issues with Special Tax Districts. The spiraling and out of control costs.

In the same minutes the group also list many questions they left open. Yet they moved forward with a recommendation without all the answers. Neither did they have a financial study or financial subcommittee to develop comparative costs of each option. And, contrary to the groups' posting yesterday, the agreement they developed does not include a budget.

This appointed, not elected, group decided to form a special tax district for recreation and sent the draft agreement to the state Attorney Generals's office for approval or rejection. The Attorney General's office has thirty days to respond. If approved by the Attorney General, the town of Essex Selecboard will need to approve putting something on a ballot for an election to happen in Essex. Yet the town recreation department and the study group are already putting out the date of an election that hasn't yet been approved by the select board about an agreement that hasn't yet been approved by the Attorney General.

An appointed group has made this decision and now will decide what it's going to cost us. A bit of the cart before the horse. In the future, let's be sure that decisions of this magnitude are not made by an appointed group.

If this is pushed thru to ballot, vote No.

Recreation Governance - Essex and Essex Junction

Mona Sheppard • [email protected] • Greenfield Road

Aug 15, 2016

I've been to a few of the committee meetings as well as an Essex Selectboard meeting concerning the new recreation taxing authority. When one makes an objection to the formation of a separate taxing district for recreation, it is assumed that we are against recreation department activities. There was even a comment that there were to many "gray haired" people at one meeting. I assume insinuating that older residents don't value the recreation functions or fear change. Actually, for myself, I simply want to be sure that all stakeholders are considered in the final decision on the best way to deliver these services.

In their June 22nd presentation, the committee said that a major reason for not choosing a number of the other choices under review was "Funding for Parks and Recreation being compromised by other municipal needs." Let that sink in. They are worried that it might be possible that there are other items in the municipal budget that might at some point in time be more important than their budget. Further, they stated the separate budget in a separate taxing authority was "protecting any school/municipal threats". If this is part of our community, why are the town tax payers and their town budget a "threat". Part of governance is making tough choices with limited funds.

At an April meeting, the Town Manager estimated that the tax rate for the new taxing authority would be 5.85 cents based on the two current budgets, but that doesn't include all the costs that are now paid by the town and not directly charged to the recreation budget, such as HR, IT, Insurance, etc. How high will the tax rate be? How many of the town assets will be given to them? What is the estimated cost of any of the options reviewed?

I believe that the taxpayers are a core set of stakeholders and their financial interests were not taken into consideration in the committee's recommendation. Preparing a budget for the only option chosen, is not comparing alternatives. I would hope that if the town and village boards put this forth on the ballet in December as currently planned, that it will be defeated.

Mona Sheppard • [email protected] • Greenfield Road

Dec 12, 2016

As you may know, town employee Ally Vile recently sent an email along with School employee Brad Luck expressing their views on the upcoming vote concerning the formation of a new governmental entity to govern the parks and recreation departments. My husband and I were both recipients of that email.

The Town of Essex Employee Handbook states that "No political activities or solicitations will be conducted on Town owned property", "Political activities are defined for the purpose of this policy as activities in support of any partisan political issues or activities", and "An employee shall not publicize or promote his or her Town employment in any activities and campaigns and shall not, in any manner, suggest that he or she represents any official position or support."

It appears that Ms. Vile violated Essex Town employment policies concerning the use of conducting activities on Town property by utilizing the town server/computer system and the recreation department records to send an email to promote her political view. Rather than identifying any of her comments as her personal opinions, she actively promoted them as the views held in her position as Director of Parks and Recreation for the Town of Essex.

If I understand the employment arrangement, the school district is Mr. Luck’s employer. CCSU conflict of interest policy states that “School employees engaging in political activity will make it clear that they are speaking and acting as individuals and that they neither represent the school district nor the views of the Board.” It would appear that Mr. Luck violated the school conflict of interest policy.

Contrary to both policies, the email from Ms. Vile and Mr. Luck begins with “We write today as the Directors at Essex Parks & Recreation (EPR) and Essex Junction Recreation & Parks (EJRP)”, after which they discuss the upcoming vote on December 13th and their views on that vote and comments on their favored governance model. There is no mention that these are personal views. They point out that they are writing in their positions as employees and they sign the email with their job titles. The email was sent from [email protected] which is not their personal address.

I'm sure you would agree that any promotion of a political view or use of taxpayer supported resources and equipment by a town employee would not be acceptable behavior. Town and school employees are servants of all the people, no matter what their personal views are. Town and school employees are in a special position where their employment or title may unduly sway voters in political situations and they should remain neutral in any such situations. That is why municipalities and other public entities have such employment policies.

I can only hope that the town and school district follow up on these alleged violations and possible similar activities by any other managers or employees that may have unduly affected the outcome of the upcoming vote on the formation of a special tax district for recreation and parks of the town and village.

There are many disadvantages to forming another tax district in our community. Please don't let such manipulations affect your vote and join me in voting "NO" to another layer of bureaucracy in Essex.

Essex Recreation STD

Mona Sheppard • [email protected] • Greenfield Road

Dec 8, 2016

Last Monday, I made a public records request for the list of email recipients that Ally Vile, Essex Parks & Recreation Director and Brad Luck, Essex Junction Parks & Recreation Director used to send their email blast out earlier this week. I believe another individual also made a request.

Rather than simply provide the listing, the town checked with their attorney to make sure they had to supply this public record. Town management doesn't know public records laws? Or is it that they don't mind wasting more taxpayer dollars for legal fees related to their quest for a recreation STD and to try to squeeze out some legal delay ruling ?

Today I received the listing and also today Ally sent a second email telling everyone they can opt out of the listing now that it is public. How much public employee time has been wasted on this controversial proposal? It's very discouraging when those who are supposed to be "public servants" are instead pushing their personal agendas with taxpayer dollars. What is the management of Essex really doing?

Are they serving us or themselves?

Please be sure to vote "NO" on December 13th or prior by absentee ballot. When a government is secretive rather than transparent, the odds are it's not good for taxpayers.

Special Recreation Tax District

Mona Sheppard • [email protected] • Greenfield Road

Dec 6, 2016

Please vote "NO" at the upcoming special election to form a new Special Tax District on December 13th to govern the town and village parks and recreation departments.

The proponents of the district, which according to a recent email blast to all recreation users includes the current directors of the Essex and Essex Junction Recreation departments, Ally Vile and Brad Luck, have had free access to town resources to send out glossy post cards, use town email lists, create a new web site, use town staff, pay legal fees,and hold public forums in public buildings. Just like good old fashioned in the streets democracy, those of us opposed to higher taxes and another layer of bureaucracy are relying on newspaper letters to the editor, front porch forum postings, letters to our legislatures, volunteers to do research and make contacts, and small private donations to pay for our web site PlanBforEssex.org, and a few street signs.

Please visit our web site and read my postings from the past few months detailing my findings about STDs, the shortcomings of the agreement we will be voting on, and other areas of misinformation put out by the proponents of the district.

Town management, legislature, and staff have currently proposed that the town do all the tax billing for the new district as well as serve as their treasurer and finance departments. The town will lease all of our parks to the district for a token amount of one dollar, but the district will maintain the assets. They will be able to request the town's $600,000 capital reserve as well as bond and take on other debt. These items and others, lead me to believe that already the district cannot be self supporting, but needs the towns's resources to survive.

If you want to protect our parks and maintain a reasonable recreation budget, please vote "NO" on December 13th or by absentee ballot. Contrary to what Brad and Ally said in their email blast, we are not afraid of change. We are opposed to increasing taxes and bureaucracy and jeopardizing our beautiful park system.

Vote "No" Early or on Dec. 13

Mona Sheppard • [email protected] • Greenfield Road

Nov 21, 2016

Early voting for the Special Tax District (STD) to take over the town and village recreation departments as well as the town and village parks begins this week.

This proposal will take away town control of the recreation department, lead to increased tax rates for the town, create another taxing district that can issue bonds, and create one more layer of bureaucracy that the voters will have to worry about.

I strongly urge a "no" vote on the creation of this district. Please read my previous postings as a counter to the spin being presented by the recreation study committee.

Whether you're going to do early voting or wait until December 13th to vote, please vote "no".

Local Government Transparency

Mona Sheppard • [email protected] • Greenfield Road

Nov 7, 2016

Last week I read the letter to the editor in the Essex Reporter by resident Bruce Post. He referred to a joint meeting of the trustees and the selectboard on June 6, 2012 that established a Committee of Six to study merger issues. The minutes weren't posted on the town website as required by law and he had to file a public records request in order to obtain them.

Imagine my surprise when I went to the town website to read those minutes and found they still aren't posted as required by law! I've made a public records request of Town Manager Pat Scheidel to get a copy. Why do the residents of the town have to make individual requests in order to get information that is our right to see and town management's responsibility to post? One would think that after Mr. Post’s public records request, town management would post the missing minutes. At this point, not so.

According to selectboard member Sue Cook at an August meeting, "the Town of Essex and Village of Essex Junction are on a trajectory to, at some point, consolidate". When and how was that decided? Was there a vote? Who is this committee? If the town and village are merging/consolidating, why is there a push to create a Special Tax District for Parks and Recreation?

At the last town meeting, when asked where the supposed $775,000 savings from current department mergers is reflected in the budget, SB Chair Max Levy stated that “the town didn't receive those savings in dollars". So ... was it in chickens? If there is no tax savings, what is going on with the merger of services? Is this simply empire building? Power grabs? The promise of lower taxes in the future or a smaller increase in taxes is simply pie in the sky.

Town Manager Pat Scheidel, when discussing the ongoing debate about a special tax district for parks and recreation and in referring to the people who pay his salary, recently said there are “people in our community… who have been overly zealous in scrutinizing processes?”

Count me one of those people. The last time I looked, I was still living in a democracy. And that demands government transparency.

Recreation Tax Rate Comparisons

Mona Sheppard • [email protected] • Greenfield Road

Oct 22, 2016

A recent reply from the Essex Recreation Governance Study Group to my posting concerning the tax rates of the Essex Junction Parks and Recreation (Village) and the Essex Parks and Recreation (Town) claims that it is misleading to compare the tax rates of the two recreation groups. Actually, it's not misleading. It's math.

The study group doesn't deny that the tax rate for the Village is 6.85 cents and the tax rate for the Town is 3.10 cents.

The numbers:

The Village recreation department collects $744,000 in taxes for parks and recreation based on a grand list of $10.9 million and a population around 10,000. That is a tax rate of 6.85 cents.

The Town recreation department collects $784,000 in taxes for parks and recreation based on a grand list almost double at $25.4 million and a population double the village at around 20,000. That is a tax rate of 3.10 cents.

Currently, the town can run a department for a town twice the size in grand list value and in population for only $40,000 more, keeping the tax rate low. Village recreation having a smaller grand list and population, should be run on half the amount of money the currently collect.

Based on the math, if the two departments merge and are run the same as they are now, you can expect taxes for residents outside the Village to increase and for residents in the Village to decrease.

I recommend a vote of "no" for the recreation taxing district.

Independent Budget for Special Tax District

Mona Sheppard • [email protected] • Greenfield Road

Oct 17, 2016

One of the questions that the Recreation Governance Study Group answered in a recent hand out had to do with what they call an "independent budget". By the group's definition, "an independent budget is money that the community will vote to approve that will only be utilized to support Essex Community Parks & Recreation." Their argument is that they are unique from other governmental functions because recreation collects taxes, but also revenue for programs.

They may be special, but they aren't unique. According to the most recent Audited Financial Statements for the town of Essex, other government activities that collect fees are general government, public safety, highways and streets, health and welfare. Other business type activities are water and sewer. All of these are included in the Town budget and are not in a Special Tax District.

I strongly disagree that an independent budget is a good idea and so do many taxpayers associations and watchdogs. Special districts which guarantee a tax revenue stream for only certain programs are bad tax policy. Budget planning needs all programs competing with each other for spending priorities in the budget. The taxpayers only have a limited amount of money and, budget shortfalls may force a town to lay off essential fire or police personnel or to not maintain roads to a high safety standard, while the Special Tax District still receives all its taxes.

Competing with other departments and having taxpayers vote on the entire municipal budget as one, helps keep tax rates in check. As an example, Essex Junction Parks and Recreation has an independent budget and their tax rate is 6.85 cents. The Essex Town Parks and Recreation doesn't have an independent budget and their tax rate is 3.1 cents.

The Town outside the Village is asked to merge with a recreation department that has a higher tax rate then our own and we are asked to increase our taxes in the name of "equalization".

I urge a "no" vote on formation of a new Special Tax District for Parks and Recreation.

Real Life Example: Special Tax District

Mona Sheppard • [email protected] • Greenfield Road

Oct 12, 2016

The proposed Special Tax District (STD) is speeding along, but there are still no answers to the questions concerning the dissolution of the Town of Essex Parks and Recreation Department. If this STD is approved, the town will no longer have a recreation department. Town recreation will be governed by a separate entity with all power in the hands of a five member board of directors with no oversight from the town management or Select board.

I've been told that there is nothing to fear here. We've been told to take a look at Snyderville Basin Recreation District in Utah. I checked their numbers.

Snyderville Basin has a bit over $3.0 million in general fund tax revenue and $1.4 million in program fees for a combined $4.4 million. That relates somewhat to the current combined numbers for the Town of Essex and Village of Essex Junction with $1.5 million in general fund tax revenue and $2.0 million in program fees for a combined total of $3.5 million. Pretty similar.

But, as we've heard and read, STDs have a tendency to bond and borrow and have uncontrollable, continually rising taxes. Snyderville seems to have proved that! According to their 12/31/2015 Audited Financial Statements, they have bonds outstanding in the amount of $58,780,000! To make payments on those bonds, they collect an additional $4,700,000 in tax revenue annually! That tax is also collected on property value.

But there's always more.

Their board passed a resolution in January, 2015 to institute Impact Fees on new builds - both residential and commercial - which brings in an additional $587,000 in revenue. That may be called a fee, but it's a tax in my world.

If Essex moves along according to this wonderful Utah district we are told to hold up as a model, we'll see large capital projects funded by bonding and increased taxes. Since the study group has said that a major reason to choose an STD is the ability to borrow money and the lack of pressure from other town budget needs, I find no reason to doubt that there will be both borrowed money and increased taxes.

Whose Parks & Recreation District?

Mona Sheppard • [email protected] • Greenfield Road

Sep 26, 2016

The proposed new special tax district to house the Town of Essex and Village of Essex Junction Parks and Recreations appears to have wide ranging goals. The recreation study group have indicated in their meetings that they may expand to include a new senior center or a farmers' market among other ideas.

In addition, although the name of the STD will be Essex Community Parks & Recreation, it is not limited to only the Town of Essex and Village of Essex Junction. According to the district's forming agreement that voters will be asked to approve in December, members of the district will also include any other municipality that joins the district.

How does another municipality join the district? Again, according to the agreement, the district's board of directors would need to vote in favor of the added municipality and then hold a special meeting of the voters of the district.

Our local legislatures and the recreation study group continue to tell us that this new STD is a way to keep the two recreation departments on an even footing. They also say that it is a better way to vote -- all by Australian vote rather than just a vote at a meeting. Yet one of the most important items is left to the board of directors and one special meeting -- no Australian vote.

Think of this -- If another town joined, we could end up with directors of the Essex Community Parks and Recreation not living in either the Town or the Village.

Wait -- there's more -- In addition to actually adding other municipalities to the district, the agreement allows other municipalities to contract for one or more services -- all at the discretion of the board. That means our Parks and Recs services are for sale to other municipalities based on the decision of a five member board.

I would urge a "no" vote on any new recreation taxing district. I hope the voters keep our Parks and Recreation under the Town or Village control.

The Selling of the Parks and Recs STD

Mona Sheppard • [email protected] • Greenfield Road

Sep 20, 2016

The Recreation Governance Study Committee continues to run its public relations program to push for the a "yes" vote on forming a Special Tax District for the combined Parks and Recreation Departments currently serving the Village and Town.

According to the group's May 4th minutes, they decided that "Once a recommendation is made to the Selectboard and the Trustees, public engagement will morph into selling the recommendation to the public".

"Selling the recommendation to the public" is not informing the public of the facts for all the options. If they're selling, what are we really buying?

In their June 22nd presentation to the joint boards, they try to sell this by saying many of the other options would leave the Parks & Recreation funding "compromised by other municipal needs." They've reworded that on their website now to say "concern of rec related funds not solely being used for recreation".

I'd like to know if these are real concerns or imagined. When did the town management and finance department use recreation program fees for anything other than recreation program costs? How often does that happen? Good accounting would dictate that these proprietary program funds not be mingled with general funds. Is this happening?

If the concern is not that the recreation program fees are being misused, but that the recreation department budget increases are held in check because of other department needs (road repair, snow plowing) that's what municipal budgeting is about. Prioritizing and compromising with taxpayer dollars.

In reading the minutes it appears that most of the "study" of this study group was to break up into smaller groups and brainstorm without actually researching real life example of these structures, nor how they function in their individual missions. Listing examples of various types of models isn't the same as reading their agreements or charters, comparing their budget sizes, reviewing actual assets managed, or discussing financing options used with their representatives.

For example, the committee notes there are no "pros" for the "non-profit" structure. As a "con", they site a "concern of oversight and transparency of large amount of public tax dollars".

Let me sight one example of a successful local non-profit -- the Underhill-Jericho Fire Department. They have plenty of oversight because this non-profit that serves two communities develops the budget with input from the towns being served, has approval from the boards of the towns for their final budget, and has direct taxpayer input at town meeting because the "tax" is a line item in the town budget. Much more oversight then a five-member board of an STD.

The minutes for the June 14th Essex Junction Board of Trustees include input from Trustee Lori Houghton, also a member of the Recreation Governance Study Committee, stating that after the State Attorney General approves the bylaws (agreement), "the committee can disband. Another committee will then be formed to do public outreach and education for the vote". That didn't happen. This study group has dug in and will not let go. They have appointed themselves the only people who can inform the public of the reasons to choose forming an STD. Why is that? If it is good research, supported by valid arguments, anyone should be able to present the options as studied and let the voter make an informed decision.

The "selling points" presented lack substance and are not supported with any real life examples of success or failure. They are full of generalities and vagueness.

I urge a "no" vote in December.

Recreation STD - Let's Talk Facts Part II

Mona Sheppard • [email protected] • Greenfield Road

Sep 16, 2016

Don’t believe everything you read — do your research.

Essex Junction Trustee Elaine Sopchak tried to counter various items from the Goldwater Study of Special Tax Districts (STD) in a recent Perspective in the Essex Reporter. As stated in my previous post, her research is full of factual errors.

She lists three STDs that she says are excellent examples and similar to the recreation STD. The Tri City Wastewater “District” is an agreement among three municipalities to use excess waste water storage facilities. They do not levy a tax. The towns sign the agreement (contract) which does not last into perpetuity as an STD does and an agreed upon fee is paid based on usage. The Union 46 School District is formed under a different statute then a municipal STD.

One of her examples, the Chittenden Solid Waste District (CSWD), is an STD. But the truth is that STDs are not all created equal. Therin lies the rub. CSWD has its own agreement just as the Recreation STD has its own.

Here are some major differences.

Composition: CSWD allocates votes to the Town of Essex and the Village of Essex as two separate entities - voters of the Village are entitled to vote only as a Village resident, they are not entitled to a second vote as a Town resident. The Recreation STD would allow Village residents to vote on taxes, changes to the agreement, dissolution, etc. as both Village residents and town residents. The result - in the Recreation STD they can vote twice.

Board of Commissions: CSWD has one commissioner from each member municipality appointed by the municipal legislative body, thus guaranteeing that the views and plans of the municipality as a whole are represented. The Recreation STD has a five member board of directors and after the initial election, there is no allocation of directors between municipalities meaning the elected officials are more likely to represent their own interests and reelection and they would not report back to the municipal boards.

Voting: With CSWD, each Commission Member is entitled to cast one vote for every 5,000 population or portion thereof. In the Recreation STD, each of the five members of the board have one vote - regardless of population represented.

Termination of Membership: A member municipality may vote to terminate membership after one year in the CSWD. The Recreation STD ties a member municipality in for at least five years before they can vote to terminate membership.

Appropriations: If the CSWD user fees and revenues do not meet the expenses, each member municipality is assessed a percentage of the obligations, based on the amount of the solid waste generated by them to the whole District - prorated usage. The Recreation STD will tax based on their expenditures without any measurement of usage or amount of municipal assets utilized.

Surplus: If the CSWD ends the fiscal year with a deficit or a surplus, that amount must be included in the operating budget of the following year. The recreation STD allows for any surplus to be used as the Board of Directors decides - it does not need to be returned to the members as a reduction in taxes.

I agree. Do the research. Check the facts.

If the creation of the STD goes to ballot as is proposed and is voted down, the Village Trustees have said they will assume governance of the Essex Junction Parks and Recreation department. Problem solved.

Recreation STD - Let's Talk Facts Part I

Mona Sheppard • [email protected] • Greenfield Road

Sep 16, 2016

I agree with Elaine Sopchak -- Don’t believe everything you read -- do your research.

Ms. Sopchak tried to counter various items from the Goldwater Study of Special Tax Districts (STD) in a recent Perspective in the Essex Reporter. Unfortunately, her research is full of factual errors.

She states that Vermont doesn’t impose debt limits on cities and towns so the concern that STDs circumvent debt limits imposed by the state is irrelevant. Vermont Statutes Title 24, Chapter 53, Paragraph 1762 states that a municipality cannot incur an indebtedness for public improvements which in the aggregate with previous indebtedness would exceed ten times the last grand list of the municipal corporation. That means that the Town of Essex could bond public improvement in an amount 10 times the grand list and the STD could do the same -- doubling the debt limits.

Ms Sopchak states that any increase in the STD taxes would result in a reduction in the Town taxes. There is no way to predict what the Town taxes will do. However, when governments get tax rates set, they seldom reduce them for any reason. I can’t say they will go up and she can’t say they will go down. We simply don’t know and there are many unmet needs in all municipal governments begging for revenues.

Ms. Sopchak asserts that the STD wouldn’t increase tax rates because the EJRP runs “like an STD” and has had a stable tax rate for 10 years. That’s a bit misleading - the past does not always predict the future. In fact, over the past few years EJRP used a prior surplus to help keep the tax rate in check. Worse still, according to their last budget presentation, they say they have “expanded programming to nearly maximum capacity which will limit increases in program revenue in the future years. This is likely the final year EJRP can present a budget with a level tax rate.”

What other costs will need to be picked up by the STD that will inflate the recreation budgets? The transition team has a two page list of items to budget for additional costs. The Village Parks and Recs has an outstanding bond for over $500,000 that won’t be paid off until 2019. That means the tax rate for the Village residents will have to be greater then the tax rate for the Town because the Town residents cannot legally be made to pay for a bond they didn’t approve.

We also don’t know what deferred maintenance is lurking and in the June 30, 2015 audit, EJRP had only $5,268 in Capital Project Funds available. Their Budget Presentation also states that the swimming pool is nearing 20 years old and will need repairs. What else is there that will lead to higher taxes since the STD won't be constrained by municipal budgeting.

The Town Parks and Recreation has over $600,000 in a capital reserve which is on the STD request list. Hopefully, our legislature won’t turn it over to them. The Town Recreation Capital Budget (these are taxes not included in the general tax rate) for the next 5 - 10 years includes $365,000 remodel for Memorial Hall which is considered a park, $30,000 for a Recreation Program Space Feasibility Study, $227,268 for Park Assets Replacements, $66,000 Milfoil Mitigation at Indian Brook, and $181,000 Indian Brook Dam Repairs. That doesn’t include the Capital Budget of $679,270 for Paths & Walks - some of which could be in Parks. The Town Administrative Director, Doug Fisher, doesn’t know the appraised value of the Town Parks, but the book value is $3,574,505. If the new STD is to maintain the Town Parks and other assets in a fashion similar to the Town, they will need to raise taxes for these capital items. Taxes that are in addition to their regular operating funds.

Ms Sopchak says that STD elections will be held at the same time as Town Meeting Day. The STD agreement is very clear concerning the timing of elections. Their elections are in April. Town Meeting is in March.

Check my next post for the differences between the STDs she uses as examples and the agreement for the Recreation STD. They are quite different.

Proposed Essex Recreation Tax District

Mona Sheppard • [email protected] • Greenfield Road

Sep 7, 2016

The committee appointed to study various options to reorganize the recreation departments for the Village and the Town has made a decision without doing due diligence. They are asking the town taxpayers to ante up for a new taxing district that will be separate from the Town or the Village. They prepared no comparative budget estimates to weigh the economic consequences to households in the Town and Village. Now they ask for us to be patient while they come up with a budget for the one option they did choose.

What will be in the budget? Some samples: The town has capable employees in HR, IT, Insurance, and Management functions. The Special Tax District (STD) needs to hire employees to perform those functions. The Town owns all the Town parks. The STD will need the Town to either sell, give, or lease them our wonderful assets. Town and Village recreation personnel who now are employees of the Town or the School District, will be employees of the new STD with STD wages and benefits. The Town prepares its budget taking into consideration all pressures of the taxes on its citizens, whether those taxes plow our roads or fund our swimming classes. The STF will prepare its own tax rate, not taking those other municipal needs into consideration.

By the committee's own power point presentation, a main reason for not looking into three of the other options was "Not chosen due to concerns of funding being compromised by other municipal needs."

The committee has submitted an agreement, asking the State Attorney General's office for approval for this new tax district that would start out governing only the town and village recreation departments, including recreation and park property. The agreement allows for adding other geographic areas or other functions to be added to its base. Taxes will be based on the grand list used for municipal taxes. If we don't like the set up - we can't vote to leave the district for five years or if the district has an outstanding bond!

A transition team is in the process of developing a budget and will also be asking the selectboard for non-binding resolutions, letters of intent, etc. concerning subjects such as leasing town parks or paying the town to do administrative work such as preparing and sending out tax bills. None of those items can be firmly established until the tax district has a Board of Directors. That means that no matter what the team comes up with as a budget it can all get thrown out the window when the tax district Board is elected and meets.

For more information on the opposing views and facts please visit planbforessex.org -- This site was put together by concerned citizens who would like to share our research with the voters.

Recreation Tax District Not Needed

Mona Sheppard • [email protected] • Greenfield Road

Aug 26, 2016

The June 22, 2016 minutes of the Recreation Governance Study Group details why they rejected the majority of the other options for the future of town and village recreation departments and instead zeroed in on a new special tax district. They did not want recreation funding to be compromised by other municipal needs.

Nationally, this is one of the major issues with Special Tax Districts. The spiraling and out of control costs.

In the same minutes the group also list many questions they left open. Yet they moved forward with a recommendation without all the answers. Neither did they have a financial study or financial subcommittee to develop comparative costs of each option. And, contrary to the groups' posting yesterday, the agreement they developed does not include a budget.

This appointed, not elected, group decided to form a special tax district for recreation and sent the draft agreement to the state Attorney Generals's office for approval or rejection. The Attorney General's office has thirty days to respond. If approved by the Attorney General, the town of Essex Selecboard will need to approve putting something on a ballot for an election to happen in Essex. Yet the town recreation department and the study group are already putting out the date of an election that hasn't yet been approved by the select board about an agreement that hasn't yet been approved by the Attorney General.

An appointed group has made this decision and now will decide what it's going to cost us. A bit of the cart before the horse. In the future, let's be sure that decisions of this magnitude are not made by an appointed group.

If this is pushed thru to ballot, vote No.

Recreation Governance - Essex and Essex Junction

Mona Sheppard • [email protected] • Greenfield Road

Aug 15, 2016

I've been to a few of the committee meetings as well as an Essex Selectboard meeting concerning the new recreation taxing authority. When one makes an objection to the formation of a separate taxing district for recreation, it is assumed that we are against recreation department activities. There was even a comment that there were to many "gray haired" people at one meeting. I assume insinuating that older residents don't value the recreation functions or fear change. Actually, for myself, I simply want to be sure that all stakeholders are considered in the final decision on the best way to deliver these services.

In their June 22nd presentation, the committee said that a major reason for not choosing a number of the other choices under review was "Funding for Parks and Recreation being compromised by other municipal needs." Let that sink in. They are worried that it might be possible that there are other items in the municipal budget that might at some point in time be more important than their budget. Further, they stated the separate budget in a separate taxing authority was "protecting any school/municipal threats". If this is part of our community, why are the town tax payers and their town budget a "threat". Part of governance is making tough choices with limited funds.

At an April meeting, the Town Manager estimated that the tax rate for the new taxing authority would be 5.85 cents based on the two current budgets, but that doesn't include all the costs that are now paid by the town and not directly charged to the recreation budget, such as HR, IT, Insurance, etc. How high will the tax rate be? How many of the town assets will be given to them? What is the estimated cost of any of the options reviewed?

I believe that the taxpayers are a core set of stakeholders and their financial interests were not taken into consideration in the committee's recommendation. Preparing a budget for the only option chosen, is not comparing alternatives. I would hope that if the town and village boards put this forth on the ballet in December as currently planned, that it will be defeated.